Market Close: Benchmark indices ended near day's low after Skymet predicts below normal monsoon due to developing El Nino.

Sensex and Nifty touched record high in the early trade today.

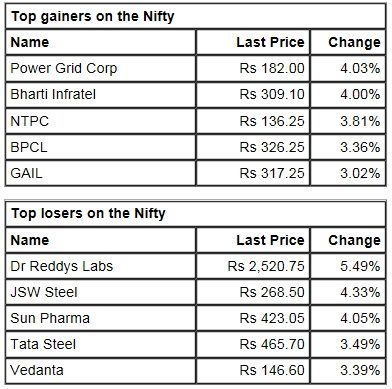

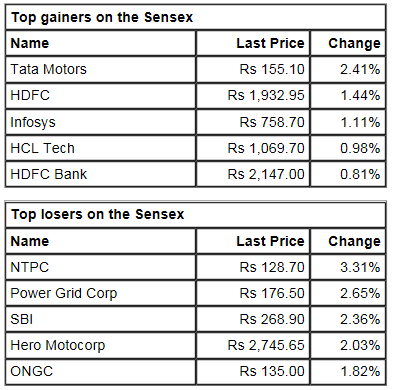

At close, the Sensex was down 179.53 points at 38877.12, while Nifty was down 69.20 points at 11,644. About 998 shares have advanced, 1574 shares declined, and 157 shares are unchanged

BPCL, Zee Entertainment, IOC, SBI and GAIL were the top losers on the Nifty, while gainers were Indiabulls Housing, Maruti Suzuki, Bajaj Finserv, HCL Tech and JSW Steel.

All the sectoral indices ended in red led by PSU bank (down 2.5 percent) followed by pharma, infra, energy, IT, metal, auto and FMCG.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-indices-revert-gains-in-late-trade-as-nifty-ends-below-11650-bpcl-down-4-3751991.html

Visit: http://www.tradeindiaresearch.com