Get daily stock tips and news with complete details on this platform. We have experienced research team which analyze share market and provide useful recommendations. For More, Visit Now!

Showing posts with label Free Intraday Tips. Show all posts

Showing posts with label Free Intraday Tips. Show all posts

Thursday, February 28, 2019

Wednesday, February 27, 2019

GST cut to boost sales of under-construction flats; no ITC may hit builders' profit margin: Moody's

Credit rating agency Moody's on Wednesday said the GST rate cut on under-construction flats will boost housing sales, but may hit profit margins of builders with withdrawal of input tax credit.

The GST Council had on Sunday decided to cut goods and services tax (GST) rate on affordable homes to 1 per cent without input tax credit (ITC) from earlier 8 per cent with ITC.

The GST on under-construction flats, which is not under the affordable housing segment, has been reduced to 5 per cent without ITC from earlier 12 per cent with ITC.

"The reduction in GST is credit positive for India's property developers...because the reduction in tax will boost demand and increase sales of properties under construction," Moody's Investors Service said in a statement.

"India's real estate sector has weathered difficulties in the last few years amid price reductions from a glut of inventory and lackluster demand. The reduction in GST will improve housing affordability as the amount to be paid by a potential house buyer will be reduced, which will increase demand for property," it added.

The reduction in GST rate on affordable housing is in line with the government's increased focus on this segment, Moody's said.

"The new GST measures eliminate the ability to claim input tax credit, which may hit the profitability of the developers," the rating agency said.

Currently, the developers are able to reduce the tax liability when it makes a sale by claiming tax paid on goods and services required for the construction of properties. "This will further impact developers' profit margins that are already under pressure."

Moody's said that the developers have the option to mitigate this loss by increasing prices slightly given that overall pricing for the customer has reduced with lower GST.

Meanwhile, Fitch Ratings said the move to reduce the GST on under-construction properties and expand the scope of the affordable-housing category would improve affordability and support demand.

"We believe this will boost consumer sentiment and cut transaction costs, which can be as high as 18 per cent in Mumbai after including other taxes, such as stamp duty, surcharge and registration fees," it said.

"The measure also withdraws input-tax credits for developers, but we still expect marginal savings on overall transaction costs and more so for affordable housing as well as improved buyer confidence, as the measure eliminates ambiguity as to whether property developers are adequately passing on input-tax credit to buyers," Fitch said.Source:https://www.moneycontrol.com/news/business/economy/gst-cut-to-boost-sales-of-under-construction-flats-no-itc-may-hit-builders-profit-margin-moodys-3589171.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Wednesday, February 20, 2019

Closing Bell: Nifty ends close to 10,750, Sensex up 403 pts; metal, oil stock in focus

Market at close: Indian indices bounced back and broke the 8-day losing streak on Wednesday with Nifty ended near to 10,750 mark helped by metal, IT and oil & gas stocks.

The Sensex was up 403.65 points at 35756.26, while Nifty was up 131.10 points at 10735.50. About 1468 shares have advanced, 1107 shares declined, and 161 shares are unchanged.

Top gainers include Indiabulls Housing, Vedanta, Tata Steel, Adani Ports and Hindalco Industries, while losers are Zee Entertainment, Hero Motocorp, Dr Reddy’s Labs, HUL and Bajaj Auto.

All the sectoral indices ended in green led by metal, IT, energy, infra, bank, pharma and auto stocks.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-ends-close-to-10750-sensex-up-403-pts-metal-oil-stock-in-focus-3560501.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Tuesday, February 19, 2019

Closing Bell: Sensex ends 145 pts lower, Nifty manages to hold 10,600; IT stocks drag

Market at close: Bears dragged the Nifty below 10,600 during last hour trading but managed to close just above the 10,600 level.

At the end, Sensex was down 145.83 points at 35352.61, while Nifty was down 36.60 points at 10604.40. About 1360 shares have advanced, 1169 shares declined, and 122 shares are unchanged.

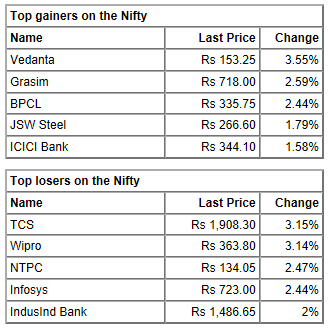

Wipro, TCS, IndusInd Bank, NTPC and Infosys were the top losers on the Nifty while top gainers include Vedanta, Grasim Industries, BPCL, Zee Entertainment, and JSW Steel.

IT space was a major drag among the sectors followed by pharma and energy, while buying was seen in FMCG, metal and PSU bank index.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-ends-145-pts-lower-nifty-manages-to-hold-10600-it-stocks-drag-3555261.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 18, 2019

Market to remain volatile till general election, invest in phased manner in select companies

The outcome of general elections in May is seen as the biggest local event that will set a direction for markets. Until then, equity gauges are expected to react to progress on global developments such as Brexit and US-China trade talks.

Foreign portfolio investors have pumped in a net of $767.77 million into Indian equities so far in February.

In a key economic development, India's merchandise trade deficit widened to $14.73 billion in January after hitting a 10-month low of $13.08 billion in December, data released by Commerce Ministry showed. The deficit was $15.67 billion in January 2018. Merchandise exports grew 3.74 percent on year to $26.36 billion, mainly due to growth in textiles, drugs and pharmaceuticals as well as organic and inorganic chemicals.

The Reserve Bank of India has warned Yes Bank of regulatory action for making public its report on divergence in violation of the confidentiality clause, the private sector lender said on February 15. The private sector lender in a press release earlier this week had said the RBI did not find any divergence in the asset classification and provisioning done by the lender during 2017-18.

In a regulatory filing on February 15, Yes Bank said it has received a letter from the RBI that noted that the Risk Assessment Report (RAR) was marked 'confidential' and it was expected that no part of the report be divulged except for the information in the form and manner of disclosure prescribed by regulations.

"Therefore, the press release breaches confidentiality and violates regulatory guidelines. Moreover, NIL divergence is not an achievement to be published and is only compliance with the extant Income Recognition and Asset Classification norms," the RBI said in its letter. This may adversely impact the stock price in the coming week.

Globally, all eyes would be on ongoing tussle between the US and China. The recent slowdown in China’s economic growth is also a cause of concern for global investors. Growing confidence that the United States and China will resolve their ongoing trade dispute will help boost global investor sentiments. Those talks will restart next week in Washington, with both sides saying this week's negotiations in Beijing showed progress. Clarity on Brexit would also act as a key trigger for investor interest.

Source:https://www.moneycontrol.com/news/business/markets/market-to-remain-volatile-till-general-election-invest-in-phased-manner-in-select-companies-3548021.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Friday, February 15, 2019

Indices close off day's low with Nifty above 10,700; metal, pharma stocks under pressure

Market at close: Benchmark indices registered strong recovery from the day's low point with Nifty able to close above 10,700 level.

The Sensex was down 67.27 points at 35808.95, while Nifty was down 21.60 points at 10724.40. About 911 shares have advanced, 1581 shares declined, and 136 shares are unchanged.

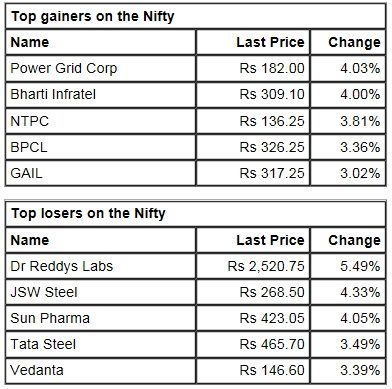

BPCL, Power Grid, NTPC, GAIL and Bharti Infratel are the top gainers, while JSW Steel, Sun Pharma, Dr Reddy’s Labs, Indiabulls Hsg and Tata Steel are among major loser on the Nifty.

Among the sectoral indices pharma, metal, auto and FMCG witnessed selling pressure, while some buying was seen in energy and infra space.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-indices-close-off-days-low-with-nifty-above-10700-metal-pharma-stocks-under-pressure-3540771.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty around 10,700, Sensex falls 100 points; pharma stocks under pressure

Market Opens: Benchmark indices started on flat note on Friday with Nifty trading below 10,750 mark.

The Sensex is down 32.22 points at 35844.00, while Nifty is down 18.30 points at 10727.70. About 332 shares have advanced, 515 shares declined, and 41 shares are unchanged.

Power Grid, BPCL, L&T, IOC, Axis Bank, ONGC, are among major gainers, while losers are Eveready, JK Tyre, Yes Bank, Nestle, Jet Airways, JSW Steel, UltraTech Cement, Hero Moto, Sun Pharma, HDFC and Vedanta.

Among sectoral indices, except energy and infra all other indices are trading in red.

Rupee Opens: The Indian rupee opened marginally lower at 71.23 per dollar on Friday versus Thursday's close 71.16.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-around-10700-sensex-falls-100-points-pharma-stocks-under-pressure-3540771.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 14, 2019

Thursday, February 7, 2019

Closing Bell: Sensex, Nifty end flat on policy day; Sun Pharma, Zee Ent gain 4% each

Market at close: Benchmark indices ended flat on Thursday with Nifty ended above 11,000 level.

RBI in its MPC meeting has cut repo rate by 25 bps at 6.25 percent.

The Sensex was down 4.14 points at 36971.09, while Nifty was up 6.90 points at 11069.40. About 1377 shares have advanced, 1145 shares declined, and 164 shares are unchanged.

Zee Entertainment, Sun Pharma, Eicher Motors, Bharti Infratel and Bajaj Auto are the top gainers on the Nifty, while losers include JSW Steel, Reliance Industries, L&T, Hindalco and Power Grid.

Among the sectors, auto, FMCG, IT and pharma index saw some buying interest, while energy and infra index remain under pressure.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-nifty-end-flat-on-policy-day-sun-pharma-zee-ent-gain-4-each-3494811.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

RBI cuts repo rate by 25 bps, raises hopes of further cuts; changes stance to 'neutral'

The central bank also sounded bullish about the prospects in the real sector, only marginally reducing its 2019-20 GDP growth forecast to 7.4 percent from 7.5 percent earlier, amid sprouting investment revival signs.

The lower repo rate—the rate at which banks borrow from the RBI— has raised hopes of bringing down EMIs for the millions of home loan borrowers as well cut capital raising costs for corporates, with banks expected to pass on the reduced rates to its customers.

The six-member Monetary Policy Committee (MPC), headed by RBI governor Shaktikanta Das, noted that large part of the current investment recovery has been driven by government spending and it was necessary to broad base the revival with a private sector boost.

RBI will meet banks in the next fortnight to discuss a range of issues, including the extent to which lenders have passed on lower repo rates to its customers, Das told journalists after presenting the policy.

In December, it had introduced a new method for fixing floating loan charges—a move that will likely force banks to change home loan rates according to the way the RBI's repo rate or government bond yields move.

The RBI also announced a string of regulatory changes including raising the limit of collateral free bank loans for farmers to Rs 1.6 lakh from Rs 1 lakh currently, among others.

Banks have also been given greater operational freedom to offer interest rates to bulk deposits, raising the definition of “bulk deposits” to Rs 2 crore from Rs 1 crore currently.

"Investment activity is recovering but supported mainly by public spending on infrastructure. The need is to strengthen private investment activity and buttress private consumption," the MPC statement said.

The focus will now shift to growth given the stability in inflation levels, said Das, who was presenting the monetary policy review after taking charge as RBI Governor in December.

There are few worry lines, both in the industrial sector, as well as the rural economy.

"First, aggregate bank credit and overall financial flows to the commercial sector continue to be strong, but are yet to be broad-based. Secondly, in spite of soft crude oil prices and the lagged impact of the recent depreciation of the Indian rupee on net exports, slowing global demand could pose headwinds. In particular, trade tensions and associated uncertainties appear to be moderating global growth," Das said.

Rabi sowing so far (up to February 1, 2019) has been lower than in the previous year, but the overall shortfall of 4 percent across various crops is expected to catch up as the season comes to a close.

“The extended period of cold weather in this year’s winter is likely to boost wheat yields, which would partly offset the shortfall, if any, in area sown,” it said.

Headline inflation will likely persist within the RBI's tolerable level of 4 percent. The RBI projected that consumer price inflation, the primary price gauge that it tracks for interest rate decisions, will be around 3.2-3.4 percent during April-September 2019, reflecting the current low inflation levels and benign food price outlook.

India's retail inflation eased to an 18-month low of 2.19 percent in driven by cheaper food items.

Crude oil prices have also moderated sharply over the last six weeks, which could push down headline inflation rate even further. This could allow the RBI more elbow room to lower lending rates, eventually bringing down borrowing costs for individuals and corporate houses.

The RBI, however, said that "some uncertainties warrant careful monitoring", flagging seven key issues.

These include the volatile vegetable prices that could reverse upwards, uncertainty in crude oil prices despite the drop in recent months, heightening global trade tensions, the unusual spike in health and education prices, volatility in financial markets, monsoon rains in the coming summer months and its impact on food prices, and lastly, the union budget proposals' effect on the real sector.

"While inflation excluding food and rule remains elevated, the recent unusual pick-up in the prices of health and education could be a one-off phenomenon," the statement said.

Inflation expectations, a broad measure of what businesses, investors and households think about how prices will change in the coming months, have softened by 80 basis points for the next three months and the 130 points in the next 12 months, according to the RBI's latest survey in December 2018.

"Inflation in the prices of farm inputs and industrial raw materials remain elevated, despite some softening. Growth in rural wages moderated in October," RBI said.

The decision to change the monetary policy stance was unanimous. Among the MPC members, Ravindra H. Dholakia, Pami Dua, Michael Debabrata Patra and Das voted in favour of a repo rate cut. Chetan Ghate and Viral V Acharya voted to keep the policy rate unchanged.

Source:https://www.moneycontrol.com/news/business/economy/rbi-cuts-repo-rate-by-25-bps-raises-hopes-of-further-cuts-changes-stance-to-neutral-3492001.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 4, 2019

Closing Bell: Nifty manages to end above 10,900, Sensex gains 113 pts; RIL market-cap above Rs 8 lk cr

Market at close: Benchmark indices bounced from the day's low to end on positive note with Nifty closed above 10,900 level.

The Sensex was up 113.31 points at 36582.74, while Nifty was up 18.60 points at 10912.30. About 799 shares have advanced, 1757 shares declined, and 172 shares are unchanged.

Reliance Industries, ONGC, Bajaj Auto, TCS and Kotak Mahindra Bank are the top gainers on the Sensex, while losers include Yes Bank, Power Grid, NTPC, Sun Pharma and M&M.

Among sectors, infra, auto, metal, FMCG and pharma witnessed selling pressure, while some buying saw in bank, energy and IT stocks.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-manages-to-end-above-10900-sensex-gains-113-pts-ril-market-cap-above-rs-8-lk-cr-3477221.html

If you need more information about the Stock Market:Visit: http://www.tradeindiaresearch.com

Friday, February 1, 2019

Sensex gains 100 points, Nifty above 10,850; Vedanta tumbles 14%

Market Opens: It is firm opening for the benchmark indices ahead of Budget announcement with Nifty holding above 10,850 level.

The Sensex is up 83.63 points or 0.23% at 36340.32, and the Nifty up 29.30 points or 0.27% at 10860.30. About 458 shares have advanced, 275 shares declined, and 34 shares are unchanged.

Dabur, Bharti Airtel, UPL are trading higher, while Vedanta tumbled 14 percent.

Banking stocks including Bank of India, OBC, Bank of Maharashtra gained 4-14% after RBI lift the lending curbs.

Piyush Goyal, the interim finance minister, is going to present the interim budget for 2019-20 in parliament today.

Rupee Opens: The Indian rupee opened higher at 71 per dollar on Friday against previous close 71.08.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sensex-gains-100-points-nifty-above-10850-vedanta-tumbles-14-3467031.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, January 31, 2019

Dabur Q3 beats estimates, profit rises 10%, domestic volume growth at 12.4%

FMCG company Dabur India has reported healthy numbers for October-December quarter as earnings beat analyst expectations on Thursday. Consolidated profit grew by 10.2 percent year-on-year to Rs 366 crore, which was ahead of CNBC-TV18 poll estimates of Rs 357 crore.

Profit in corresponding period last fiscal stood at Rs 332 crore.

Consolidated revenue during the quarter increased 11.8 percent year-on-year to Rs 2,199 crore with healthy domestic volume growth at 12.4 percent against 13 percent in same period last year.

"Prudent cost management initiatives coupled with strong growth in the domestic market across our key business categories helped Dabur India Ltd mitigate the weaker economic indicators and macro-economic headwinds in some international markets to deliver a strong overall performance in the third quarter of 2018-19 financial year," the company said.

A CNBC-TV18 poll estimates for revenue stood at Rs 2,169 crore and domestic volume growth at 8-10 percent.

Dabur's shampoo business grew by 25.2 percent and hair oil business was up 23.6 percent, helping the hair care category report a nearly 24 percent growth during the quarter.

The skin & salon business ended the quarter with a 19.3 percent growth, while the OTC & ayurvedic ethicals business grew by 17.6 percent.

Dabur's toothpaste sales, led by continued demand for flagship Dabur Red Paste, was up 11.1 percent while the foods business also grew by 11.1 percent.

Sunil Duggal, Chief Executive Officer, said, "The medium-term prospects for India remain robust and we are confident that domestic consumer sentiment, particularly in rural markets, will gain pace in the months to come on the back of fiscal stimulus."

At operating level too, numbers were ahead of estimates. Consolidated EBITDA (earnings before, interest, tax, depreciation and amortisation) in Q3 increased 4.3 percent to Rs 445.2 crore, but margin contracted to 20.2 percent against 20.5 percent YoY.

A CNBC-TV18 poll expectations for EBITDA stood at Rs 433 crore and margin at 20 percent for the quarter.

SP Tulsian of sptulsian.com told CNBC-TV18 that Dabur reported very good numbers for the quarter. "Considering the good rabi crop season and likely continuity in rural consumption growth, Dabur is expected to trade strong going ahead."

Even if it does 10 percent volume growth, numbers are expected to remain good going ahead, according to him.

The stock was quoting at Rs 433, up Rs 2.15, or 0.50 percent on the BSE, at 14:48 hours IST.

Source: https://www.moneycontrol.com/news/business/earnings/dabur-q3-beats-estimates-profit-rises-10-domestic-volume-growth-at-12-4-3462671.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, January 28, 2019

Friday, January 25, 2019

Nifty above 10,900, Sensex gains 250 points; IT stocks trade higher

Market Opens: Benchmark indices started the day on positive note with Nifty is trading above 10,900 level.

The Sensex is up 201.85 points at 36396.95, while Nifty is up 59.60 points at 10909.40. About 445 shares have advanced, 240 shares declined, and 35 shares are unchanged.

Yes Bank gained 10 percent in early trade on appointment of Ravneet Gill as new MD & CEO. UPL, Bharti Infratel, Sun Pharma, Bhrati Airtel, RIL, Axis Bank, TCS are other mojor gainers, while ICICI Bank and HDFC Bank are trading lower.

Rupee Opens: The Indian rupee opened higher at 71 per dollar on Friday against previous close 71.07.

Source: https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sgx-nifty-indicates-gap-up-opening-for-indian-indices-3433321.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, January 24, 2019

Subscribe to:

Posts (Atom)

Closing Bell: Sensex ends 192 pts lower, Nifty below 11,600 even as RBI cuts rate

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

CLOSING BELL:- SENSEX UP +242.82 @ 35726.29 NIFTY FUTURE UP +61.20 @ 10847.00 BANKNIFTY FUTURE UP +159.00 @ 26636.00 I...

-

If you want more information regardingtheMarket News & many other tips like Intraday Tips , MCX Normal Calls , Indore Advisory Compan...

-

Gold gained on Thursday, supported by an easing dollar as investors awaited progress on the ongoing Sino-U.S. trade negotiations after...