Market Opens: It is a strong start for the indices on Thursday with Nifty trading around 10,850 level.

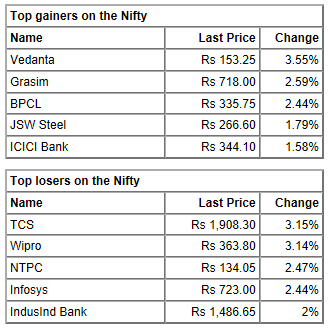

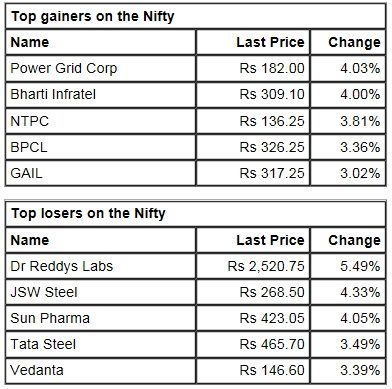

At 09:18 hrs IST, the Sensex is up 139.66 points at 36045.09, while Nifty is up 40.90 points at 10847.60. About 525 shares have advanced, 138 shares declined, and 33 shares are unchanged.

Tata Metaliks, Future Retail, Yes Bank, Tata Motors, Coal India, Adani Ports, Quick Heal, Motherson Sumi, Balrampur Chini, Maruti Suzuki are among major gainers on the indices, while losers are ONGC, Wipro, Indiabulls Housing, Jet Airways, Odisha Cement, TCS and HCL Tech.

All the sectoral indices are trading in green led by PSU bank, auto, energy and FMCG.

Rupee Opens: The Indian rupee opened lower at 71.26 per dollar on Thursday versus Wednesday's close 71.22.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-above-10800-sensex-up-100-pts-ioc-sun-pharma-top-gainers-3591771.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com