Get daily stock tips and news with complete details on this platform. We have experienced research team which analyze share market and provide useful recommendations. For More, Visit Now!

Tuesday, January 22, 2019

Sensex down over 100 points, Nifty around 10,900; Sun Pharma up 3%

Market opens It’s a negative start to the market on Tuesday morning, with the Sensex falling around 100 points. The Nifty is below 10,950-mark.

Weakness is visible among automobiles, banks, energy, IT and metal names, while Nifty Pharma index is trading higher. Gains in Sun Pharma are leading the charts for Nifty Pharma. The Nifty Midcap index is down around 0.25 percent.

The Sensex is down 98.12 points or 0.27% at 36480.84, while the Nifty is lower by 35.90 points or 0.33% at 10926.00. The market breadth was narrow as 209 shares advanced, against a decline of 178 shares, while 38 shares were unchanged.

Sun Pharma and Kotak Mahindra Bank are the top gainers, while Axis Bank, M&M, Hindalco and TCS lost the most

Rupee Opens: The Indian rupee opened marginally higher at 71.22 per dollar on Tuesday versus 71.28 Monday.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sensex-down-over-100-points-nifty-around-10900-sun-pharma-up-3-3417771.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, January 21, 2019

IT stocks surge as rupee extends fall to near 71.50/$

Shares of information technology (IT) companies rose in trade as the rupee saw some depreciation.

After falling to 71.34 per US dollar against its previous close of 71.18 per US dollar, the rupee has further extended its fall to nearly 71.50 per US dollar.

Rupee fell in the latter half of the session on Friday primarily as global crude oil prices continued to rally after supply cuts led by OPEC supported prices. OPEC issued a list of oil production cuts by its members and other major producers for six months starting on January 1 to boost confidence in its oil supply reduction pact.

Last week, OPEC’s monthly report showed it had made a strong start in December before the pact went into effect, implementing the biggest month-on-month production drop in almost two years. Today, USD-INR pair is expected to quote in the range of 70.70 and 71.50, said Motilal Oswal.

A weaker rupee is seen as a positive cue for IT companies as it means better revenue.

Source: https://www.moneycontrol.com/news/business/markets/it-stocks-surge-as-rupee-extends-fall-to-near-71-50-3413801.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

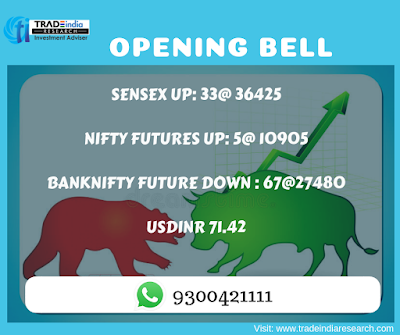

Nifty around 10,900, Sensex flat; L&T slips on buyback rejection by SEBI

Market opens: Benchmark indices started the week on a flat note with Nifty holding above 10,900 level.

The Sensex is up 30.57 points at 36417.18, while Nifty is down 0.40 points at 10906.60. About 386 shares have advanced, 448 shares declined, and 56 shares are unchanged.

HDFC Bank, Sun Pharma, NTPC, Infosys, RIL are trading higher, while Wipro, L&T, IOC, BPCL, TCS, Jet Airways, South Indian Bank, DCB Bank, are among major losers.

Rupee Opens: The Indian rupee opened lower by 18 paise at 71.36 per dollar on Monday versus Friday's close 71.18.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-around-10900-sensex-flat-lt-slips-on-buyback-rejection-by-sebi-3413441.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Subscribe to:

Comments (Atom)

Closing Bell: Sensex ends 192 pts lower, Nifty below 11,600 even as RBI cuts rate

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

Market Opens: It is flat start for the Indian indices ahead of RBI policy meeting. At 09:19 hrs IST, the Sensex is up 45.55 points ...

-

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

The Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6 percent on April 4 as expected and kept the stance unchanged to ‘Neut...