Market opens It’s a negative start to the market on Tuesday morning, with the Sensex falling around 100 points. The Nifty is below 10,950-mark.

Weakness is visible among automobiles, banks, energy, IT and metal names, while Nifty Pharma index is trading higher. Gains in Sun Pharma are leading the charts for Nifty Pharma. The Nifty Midcap index is down around 0.25 percent.

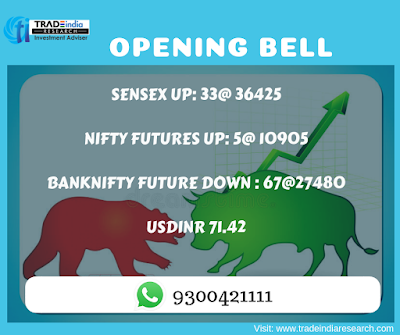

The Sensex is down 98.12 points or 0.27% at 36480.84, while the Nifty is lower by 35.90 points or 0.33% at 10926.00. The market breadth was narrow as 209 shares advanced, against a decline of 178 shares, while 38 shares were unchanged.

Sun Pharma and Kotak Mahindra Bank are the top gainers, while Axis Bank, M&M, Hindalco and TCS lost the most

Rupee Opens: The Indian rupee opened marginally higher at 71.22 per dollar on Tuesday versus 71.28 Monday.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sensex-down-over-100-points-nifty-around-10900-sun-pharma-up-3-3417771.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com