Get daily stock tips and news with complete details on this platform. We have experienced research team which analyze share market and provide useful recommendations. For More, Visit Now!

Showing posts with label Free Stock Tips. Show all posts

Showing posts with label Free Stock Tips. Show all posts

Wednesday, March 6, 2019

Saturday, March 2, 2019

February keeps up box office momentum in 2019 with business of over Rs 300 crore

While January set the pace for Bollywood in 2019 with collections in the range of Rs 300- Rs 350 crore, February is maintaining the momentum with revenues to the tune of Rs 310 crore. And this is despite no holiday advantage and an added pressure of school examinations.

The month saw films like multi-starrer comedy flick Total Dhamaal and musical drama Gully Boy scoring high at the box office. For the Ranveer Singh-starrer Valentine's Day boosted the film's growth with the film having all the ingredients to attract the young audience.

On the day of love the film grabbed as much as Rs 19.40 crore which is close to 20 percent of the film's week one total. The right content at the right time helped Gully Boy enter the Rs 100 crore club in eight days.

On the other hand, the third installment in the Total Dhamaal franchise clicked with the family audience and managed Rs 99.30 crore in its first week.

Film trade experts are confident that Total Dhamaal will cross Rs 100 on day nine. Its overseas total also stands strong with a business of Rs 30.95 crore in seven days of its release.

While the film faced strong competition from the new release Luka Chuppistarring Kartik Aaryan and Kriti Sanon on day eight, it is still gathering steam.

Looking at Total Dhamaal's solid hold in theatres, film trade analyst Taran Adarsh said that contribution from mass pockets and single screens should not be overlooked and more movies that hold pan-India appeal should be made to expect ache din for trade.

With Total Dhamaal maintaining its rhythm and Luka Chuppi packing up strong revenues, it looks like the genre of comedy will keep the entertainment quotient high even in the month of March.

The other two releases during this month Amavas and Ek Ladki ko Dekha toh Aisa Laga did not contribute much to the overall collections as the former added only Rs 2.85 crore and the latter earned Rs 20 crore.

But the month had something interesting to celebrate and that was Uri: The Surgical Strike trending even in its seventh week. The spillover effect of Uri added around Rs 66 crore to the grand total and the film yet shows no signs of slowing down despite competition from new releases and holdovers.

Down south a handful of films kept the audience entertained. Out of 10 releases from Tamil and Telugu industries together, RJ Balaji-starrer LKG made waves at the box office.

Reports estimate the film’s collection from the Tamil Nadu market at around Rs 10 crore and worldwide numbers at Rs 16 crore. LKG opened in theatres on February 22.

Telugu film NTR Mahanayakudu despite receiving positive reviews from critics could not hold strong at the box office. Its business in Andhra Pradesh and Telangana market remained disappointing as it could gather Rs 304 lakh by the end of four days of its theatrical run in the two territories.

As for Hollywood, February saw some decent business coming from James Cameron’s Alita: The Battle Angelthat minted over Rs 8 crore total in India. However, it will be Captain Marvel that will up the interest amid the fan-base for Hollywood films in India.

Source:If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Friday, March 1, 2019

Closing bell: Nifty snaps 3-day fall, Sensex gains 196 pts; Midcap, Smallcap indices outshine

The market snapped its three-day losing streak and closed half a percent higher, but the broader markets staged smart show on strong breadth.

The 30-share BSE Sensex rallied 196.37 points to 36,063.81 and the Nifty50 gained 71 points at 10,863.50.

About three shares advanced for every share falling on the BSE.

IndusInd Bank, ICICI Bank, HDFC, L&T and Infosys were leading contributors while Bharti Airtel, Axis Bank, UPL and Bajaj Auto were under pressure.

Among broader space, TVS Motor Company, Jet Airways, NALCO, Union Bank, Vijaya Bank, SAIL, RCF, Wockhardt, Dish TV, Meghmani Organics and OBC rallied 4-11 percent.

Marico, Motherson Sumi and Havells India were under pressure.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-snaps-3-day-fall-sensex-gains-196-pts-midcap-smallcap-indices-outshine-3597211.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty around 10,850, Mid-Smallcap indices strong; SAIL rallies 8%

Benchmark indices started off last day of the week on a strong note after three-day fall. Likely de-escalation between India and Pakistan after Pakistan Prime Minister announced that his country will release captured IAF Wing Commander lifted sentiment.

The 30-share BSE Sensex rallied 223.53 points to 36,090.97 and the Nifty50 rose 63.80 points to 10,856.30 on first day of March series.

Rupee Opening:

The Indian rupee has opened marginally lower at 70.74 against the US dollar, against Thursday's close of 70.72 a dollar.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-around-10850-mid-smallcap-indices-strong-sail-rallies-8-3597211.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 28, 2019

Nifty above 10,800, Sensex up 100 pts; IOC, Sun Pharma top gainers

Market Opens: It is a strong start for the indices on Thursday with Nifty trading around 10,850 level.

At 09:18 hrs IST, the Sensex is up 139.66 points at 36045.09, while Nifty is up 40.90 points at 10847.60. About 525 shares have advanced, 138 shares declined, and 33 shares are unchanged.

Tata Metaliks, Future Retail, Yes Bank, Tata Motors, Coal India, Adani Ports, Quick Heal, Motherson Sumi, Balrampur Chini, Maruti Suzuki are among major gainers on the indices, while losers are ONGC, Wipro, Indiabulls Housing, Jet Airways, Odisha Cement, TCS and HCL Tech.

All the sectoral indices are trading in green led by PSU bank, auto, energy and FMCG.

Rupee Opens: The Indian rupee opened lower at 71.26 per dollar on Thursday versus Wednesday's close 71.22.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-above-10800-sensex-up-100-pts-ioc-sun-pharma-top-gainers-3591771.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 25, 2019

Friday, February 22, 2019

Closing Bell: Sensex, Nifty end a rangebound session flat; metal stocks outperform

Market Close: Benchmark indices ended flat on Friday after trading in narrow range throughout the day.

The Sensex was down 26.87 points at 35871.48, while Nifty was up 1.80 points at 10791.70. About 1602 shares have advanced, 906 shares declined, and 148 shares are unchanged.

IOC, HPCL, JSW Steel, Vedanta and Yes Bank were the top gainers on the Nifty, while losers include Kotak Mahindra Bank, GAIL, HDFC Bank, Reliance Industries and Cipla.

Among the sectors, except energy and bank all other sectoral indices ended in green.

Source:https://www.moneycontrol.com/news/business/markets/sensex-nifty-end-a-rangebound-session-flat-metal-stocks-outperform-3570331.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Kotak Mahindra Bank falls over 4% on block deals; ING may have sold stake

Kotak Mahindra Bank shares fell over 4 percent in morning trade as 8.3 crore shares worth Rs 10,307 crore traded on both indices.

"5.87 crore shares (3% stake) equity trade in multiple blocks. ING may have sold stake in Kotak Mahindra Bank via block deal," said CNBC-TV18.

There were media reports which suggested that ING Mauritius Investments is likely to sell 1.2 percent in Kotak Mahindra Bank (KMB) via block deal at ~3-5 percent discount.

ING Group may sell 23 lakh shares, or 1.20 percent equity, at the price of Rs 1,125-1,250 per share, said multiple media reports.

On February 21, the Kotak Mahindra stock closed marginally lower at Rs 1,288.90 on the BSE.

ING Group merged its banking unit, ING Vysya Bank, with Kotak Mahindra Bank in November 2014. After the deal, the former held 6.5 percent stake in the merged entity, but offloaded some its stake later.

At 10:00 hrs, the Kotak Bank stock was trading at Rs 1,242, down 46.90 points or -3.64%, on the BSE.

Source:https://www.moneycontrol.com/news/business/markets/kotak-mahindra-bank-falls-over-4-on-block-deals-ing-may-have-sold-stake-3570881.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Sensex, Nifty open flat with negative bias; Kotak Mahindra Bank falls 4%

Market Opens: Benchmark indices opened flat with negative bias on Friday with Nifty holding above 10,750 level.

At 09:17 hrs IST, the Sensex is down 36.45 points at 35861.90, while Nifty was down 15.10 points at 10774.80. About 400 shares have advanced, 347 shares declined, and 38 shares are unchanged.

Bajaj Auto, Maruti Suzuki, ICICI Bank, HUL, BPCL, HPCL, IOC, HDFC Bank are the top gainers in the morning, while losers is Kotak Mahindra Bank.

Rupee Opens: The Indian rupee opened flat at 71.25 per dollar on Friday versus previous close 71.25.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sensex-nifty-opens-flat-with-negative-bias-kotak-mahindra-bank-falls-4-3570331.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 21, 2019

Indices trade flat with a positive bias; TechM approves buyback at Rs 950/sh

Market Opens: It is flat start for the benchmark indices on Thursday with Nifty hovering around 10,750 mark

The Sensex is up 7.59 points at 35763.85, while Nifty is down 5.30 points at 10730.20. About 428 shares have advanced, 333 shares declined, and 42 shares are unchanged.

Tech Mahindra, Allahabad Bank, ICICI Bank, SBI, Indiabulls Housing, are among major gainers, while losers are Reliance Power, BPCL, HPCL, IOC, Bharti Airtel, Vodafone Ida, TCS and Yes Bank.

Tech Mahindra to BSE: Approved the proposal for buyback by the Company of its own fully paid equity shares of Rs 5 each not exceeding 20,585,000 equity shares. The record date will be March 6, 2019 at an offer price of Rs 950 for an aggregate amount not exceeding Rs 1,956 crore.

Rupee Opens: The Indian rupee opened marginally higher at 71.07 per dollar on Thursday versus previous close 71.11.

Source:https://www.moneycontrol.com/news/business/markets/market-live-indices-trade-flat-with-a-positive-bias-techm-approves-buyback-at-rs-950sh-3565841.html

Visit: http://www.tradeindiaresearch.com

Wednesday, February 20, 2019

Closing Bell: Nifty ends close to 10,750, Sensex up 403 pts; metal, oil stock in focus

Market at close: Indian indices bounced back and broke the 8-day losing streak on Wednesday with Nifty ended near to 10,750 mark helped by metal, IT and oil & gas stocks.

The Sensex was up 403.65 points at 35756.26, while Nifty was up 131.10 points at 10735.50. About 1468 shares have advanced, 1107 shares declined, and 161 shares are unchanged.

Top gainers include Indiabulls Housing, Vedanta, Tata Steel, Adani Ports and Hindalco Industries, while losers are Zee Entertainment, Hero Motocorp, Dr Reddy’s Labs, HUL and Bajaj Auto.

All the sectoral indices ended in green led by metal, IT, energy, infra, bank, pharma and auto stocks.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-ends-close-to-10750-sensex-up-403-pts-metal-oil-stock-in-focus-3560501.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty above 10,650, Sensex up 200 pts; realty stocks in focus

At 09:17 hrs IST, the Sensex is up 196.95 points at 35549.56, while Nifty is up 63.50 points at 10,667.90. About 595 shares have advanced, 249 shares declined, and 49 shares are unchanged.

Shriram Trasport, ITI, Yes Bank, Indiabulls Housing, Vedanta, Power Grid, Dr Reddy's Lab, Grasim, Bajaj Finserv, are among major gainers, while losers include Zee Entertainment, Reliance Capital.

All the sectoral indices are trading in green led by realty, energy, metal, infra, pharma and FMCG.

Rupee Opens: The Indian rupee opened marginally higher at 71.29 per dollar versus Monday's close 71.34.

Source: https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sensex-up-100-pts-in-pre-open-nifty-around-10650-essel-propack-gains-8-3560501.html

If you need more information about the Stock Market:Visit: http://www.tradeindiaresearch.com

Tuesday, February 19, 2019

Closing Bell: Sensex ends 145 pts lower, Nifty manages to hold 10,600; IT stocks drag

Market at close: Bears dragged the Nifty below 10,600 during last hour trading but managed to close just above the 10,600 level.

At the end, Sensex was down 145.83 points at 35352.61, while Nifty was down 36.60 points at 10604.40. About 1360 shares have advanced, 1169 shares declined, and 122 shares are unchanged.

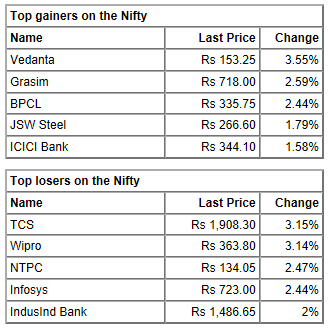

Wipro, TCS, IndusInd Bank, NTPC and Infosys were the top losers on the Nifty while top gainers include Vedanta, Grasim Industries, BPCL, Zee Entertainment, and JSW Steel.

IT space was a major drag among the sectors followed by pharma and energy, while buying was seen in FMCG, metal and PSU bank index.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-ends-145-pts-lower-nifty-manages-to-hold-10600-it-stocks-drag-3555261.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Friday, February 15, 2019

Nifty forms 'Bearish Belt Hold' pattern on weekly charts, tread with caution

The Nifty50 managed to trim losses in the second half and closed off day's low amid weak Asian cues on Friday, but the broader markets caught in complete bear trap as the Nifty Midcap and Smallcap indices were down a percent each.

The index registered a bearish candle, which resembles a Hammer kind of formation on the daily charts and 'Bearish Belt Hold' pattern on the weekly scale.

Hammer formations on daily charts should have bullish connotations for the near term, but traders need to be cautious as weakness on weekly charts is getting more pronounced, experts said.

A 'Bearish Belt Hold' pattern is formed when the opening price becomes the highest point of the trading day (intraday high) and the index declines throughout the trading day making up for the large body. The candle will either have a small or no upper shadow and a small lower shadow.

A Hammer which is a bullish reversal pattern is formed after a decline while a Hanging Man is a bearish reversal pattern. A Hammer consists of no upper shadow, a small body, and long lower shadow. The long lower shadow of the Hammer signifies that it tested its support where demand was located and then bounced back.

The Nifty50 after opening moderately higher managed to hit an intraday high of 10,785.75 in early trade itself, but immediately bears took the control of Dalal Street and the index fell up to 10,620.40 in afternoon, followed by a bit of recovery in second half of session. The index cut down losses and closed down 21.60 points at 10,724.40.

"It was heartening to see Nifty50 staging a pull back move from the critical supports, placed around 10,600, as it recouped all the intraday losses which resulted in a Hammer kind of formation with a long lower shadow but weekly charts depicted a Bearish Belt Hold formation as Nifty continued to remain under pressure throughout the week from the highs of 10,930," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

He said usually Hammer formations on daily charts should have bullish connotations for the near term provided in the immediate session market witness a follow through buying.

In such a scenario sustaining above 10,700 levels on closing basis Nifty should ideally target 10,900 levels, he added.

Source:https://www.moneycontrol.com/news/business/markets/technical-view-nifty-forms-bearish-belt-hold-pattern-on-weekly-charts-tread-with-caution-3544931.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 14, 2019

Wednesday, February 13, 2019

Inflation drops to 2.05%, lower than RBI's projection a week ago

There is something to be said about inflation. It's a number that is stubbornly refusing to rise. January inflation came in at just 2.05 percent, a near-two year low. And it's happening like this: the inflation index is actually falling – and falling even more than it fell last year.

Which brings us to the components. While food is still an important part of the index, it's still "deflating" – prices of food items are falling, in general. This is usual for January (as winter crops come abound) but we see that this time, there was more "abundance" than last year.

If you need more information about the Stock Market:

Which brings us to the components. While food is still an important part of the index, it's still "deflating" – prices of food items are falling, in general. This is usual for January (as winter crops come abound) but we see that this time, there was more "abundance" than last year.

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Source:https://www.moneycontrol.com/news/business/economy/inflation-drops-to-2-05-lower-than-rbis-projection-a-week-ago-3529521.html

Indices trim gains with Nifty below 10,850; auto stocks under pressure

Market Opens: Benchmark indices opened higher on Wednesday with Nifty trading above 10,850 mark.

The Sensex is up 199.06 points at 36352.68, while Nifty is up 58.60 points at 10890. About 506 shares have advanced, 285 shares declined, and 33 shares are unchanged.

Sun Pharma, ITC, Cola India, Indiabulls Housing, Jet Airways, ONGC, Bata, JSW Steel, TCS, RIL are the top gainers on the indices, while losers are HPCL, Infosys, Axis Bank.

Rupee Opens: The Indian rupee gained in the early trade on Wednesday. It has opened higher by 22 paise at 70.48 per dollar versus previous close 70.70.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-indices-trim-gains-with-nifty-below-10850-auto-stocks-under-pressure-3525251.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Subscribe to:

Posts (Atom)

Closing Bell: Sensex ends 192 pts lower, Nifty below 11,600 even as RBI cuts rate

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

CLOSING BELL:- SENSEX UP +242.82 @ 35726.29 NIFTY FUTURE UP +61.20 @ 10847.00 BANKNIFTY FUTURE UP +159.00 @ 26636.00 I...

-

If you want more information regardingtheMarket News & many other tips like Intraday Tips , MCX Normal Calls , Indore Advisory Compan...

-

Gold gained on Thursday, supported by an easing dollar as investors awaited progress on the ongoing Sino-U.S. trade negotiations after...