Get daily stock tips and news with complete details on this platform. We have experienced research team which analyze share market and provide useful recommendations. For More, Visit Now!

Showing posts with label Equity Trading Tips. Show all posts

Showing posts with label Equity Trading Tips. Show all posts

Monday, February 25, 2019

Saturday, February 23, 2019

PM Modi sees India as $10-trillion economy with countless startups

Prime Minister Narendra Modi on Sunday laid out his vision for making India a USD 10-trillion economy, and the third-largest in the world, saying he wants the nation to have countless startups, and be a global leader in electric vehicles.

Speaking at the Global Business Summit here, he said his government inherited an economy in complete policy paralysis, plagued by runaway inflation and rising current account deficit.

Reforms in the last four and half years have changed the picture. "Change is clearly visible today," he said.

Source:https://www.moneycontrol.com/news/business/economy/pm-modi-sees-india-as-10-trillion-economy-with-countless-startups-3574701.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Friday, February 22, 2019

Sensex, Nifty open flat with negative bias; Kotak Mahindra Bank falls 4%

Market Opens: Benchmark indices opened flat with negative bias on Friday with Nifty holding above 10,750 level.

At 09:17 hrs IST, the Sensex is down 36.45 points at 35861.90, while Nifty was down 15.10 points at 10774.80. About 400 shares have advanced, 347 shares declined, and 38 shares are unchanged.

Bajaj Auto, Maruti Suzuki, ICICI Bank, HUL, BPCL, HPCL, IOC, HDFC Bank are the top gainers in the morning, while losers is Kotak Mahindra Bank.

Rupee Opens: The Indian rupee opened flat at 71.25 per dollar on Friday versus previous close 71.25.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-sensex-nifty-opens-flat-with-negative-bias-kotak-mahindra-bank-falls-4-3570331.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 21, 2019

Nifty forms bullish candle for 2nd day; 10,900 crucial resistance

Bulls remained in control of D-Street for the second consecutive day in a row on Thursday after falling for eight consecutive days in a row and formed a bull candle on the daily charts.

The index is comfortable trading above 100-day moving average as well as 5, and 13-DEMA on the daily charts which is a positive sign for the bulls, but for bulls to regain control, the index has to hold above 10,900 levels, suggest experts.

But, it somebody plans to go long on the index then trading with strict stop losses is a better bet for capital preservation. A trailing stop loss below 10640 should be kept for all long positions, they say.

The touch-and-go moment with 10,800 suggests that there is some pressure at higher levels. The Nifty50 which opened at 10,744 slipped to an intraday low of 10,721 before it bounced back towards 10800. The index hit an intraday high of 10808 before closing at 10,789 up 54 points.

Source:https://www.moneycontrol.com/news/business/markets/technical-view-nifty-forms-bullish-candle-for-2nd-day-10900-crucial-resistance-3568641.html

If you need more information about the Stock Market:Visit: http://www.tradeindiaresearch.com

Wednesday, February 20, 2019

Closing Bell: Nifty ends close to 10,750, Sensex up 403 pts; metal, oil stock in focus

Market at close: Indian indices bounced back and broke the 8-day losing streak on Wednesday with Nifty ended near to 10,750 mark helped by metal, IT and oil & gas stocks.

The Sensex was up 403.65 points at 35756.26, while Nifty was up 131.10 points at 10735.50. About 1468 shares have advanced, 1107 shares declined, and 161 shares are unchanged.

Top gainers include Indiabulls Housing, Vedanta, Tata Steel, Adani Ports and Hindalco Industries, while losers are Zee Entertainment, Hero Motocorp, Dr Reddy’s Labs, HUL and Bajaj Auto.

All the sectoral indices ended in green led by metal, IT, energy, infra, bank, pharma and auto stocks.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-ends-close-to-10750-sensex-up-403-pts-metal-oil-stock-in-focus-3560501.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Tuesday, February 19, 2019

Closing Bell: Sensex ends 145 pts lower, Nifty manages to hold 10,600; IT stocks drag

Market at close: Bears dragged the Nifty below 10,600 during last hour trading but managed to close just above the 10,600 level.

At the end, Sensex was down 145.83 points at 35352.61, while Nifty was down 36.60 points at 10604.40. About 1360 shares have advanced, 1169 shares declined, and 122 shares are unchanged.

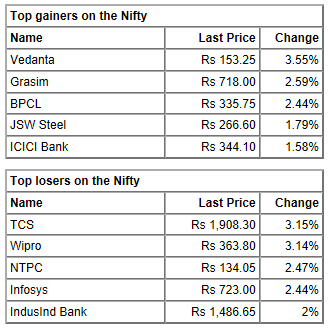

Wipro, TCS, IndusInd Bank, NTPC and Infosys were the top losers on the Nifty while top gainers include Vedanta, Grasim Industries, BPCL, Zee Entertainment, and JSW Steel.

IT space was a major drag among the sectors followed by pharma and energy, while buying was seen in FMCG, metal and PSU bank index.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-ends-145-pts-lower-nifty-manages-to-hold-10600-it-stocks-drag-3555261.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 18, 2019

Friday, February 15, 2019

Indices close off day's low with Nifty above 10,700; metal, pharma stocks under pressure

Market at close: Benchmark indices registered strong recovery from the day's low point with Nifty able to close above 10,700 level.

The Sensex was down 67.27 points at 35808.95, while Nifty was down 21.60 points at 10724.40. About 911 shares have advanced, 1581 shares declined, and 136 shares are unchanged.

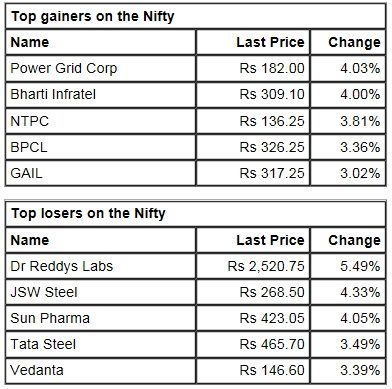

BPCL, Power Grid, NTPC, GAIL and Bharti Infratel are the top gainers, while JSW Steel, Sun Pharma, Dr Reddy’s Labs, Indiabulls Hsg and Tata Steel are among major loser on the Nifty.

Among the sectoral indices pharma, metal, auto and FMCG witnessed selling pressure, while some buying was seen in energy and infra space.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-indices-close-off-days-low-with-nifty-above-10700-metal-pharma-stocks-under-pressure-3540771.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty forms 'Bearish Belt Hold' pattern on weekly charts, tread with caution

The Nifty50 managed to trim losses in the second half and closed off day's low amid weak Asian cues on Friday, but the broader markets caught in complete bear trap as the Nifty Midcap and Smallcap indices were down a percent each.

The index registered a bearish candle, which resembles a Hammer kind of formation on the daily charts and 'Bearish Belt Hold' pattern on the weekly scale.

Hammer formations on daily charts should have bullish connotations for the near term, but traders need to be cautious as weakness on weekly charts is getting more pronounced, experts said.

A 'Bearish Belt Hold' pattern is formed when the opening price becomes the highest point of the trading day (intraday high) and the index declines throughout the trading day making up for the large body. The candle will either have a small or no upper shadow and a small lower shadow.

A Hammer which is a bullish reversal pattern is formed after a decline while a Hanging Man is a bearish reversal pattern. A Hammer consists of no upper shadow, a small body, and long lower shadow. The long lower shadow of the Hammer signifies that it tested its support where demand was located and then bounced back.

The Nifty50 after opening moderately higher managed to hit an intraday high of 10,785.75 in early trade itself, but immediately bears took the control of Dalal Street and the index fell up to 10,620.40 in afternoon, followed by a bit of recovery in second half of session. The index cut down losses and closed down 21.60 points at 10,724.40.

"It was heartening to see Nifty50 staging a pull back move from the critical supports, placed around 10,600, as it recouped all the intraday losses which resulted in a Hammer kind of formation with a long lower shadow but weekly charts depicted a Bearish Belt Hold formation as Nifty continued to remain under pressure throughout the week from the highs of 10,930," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

He said usually Hammer formations on daily charts should have bullish connotations for the near term provided in the immediate session market witness a follow through buying.

In such a scenario sustaining above 10,700 levels on closing basis Nifty should ideally target 10,900 levels, he added.

Source:https://www.moneycontrol.com/news/business/markets/technical-view-nifty-forms-bearish-belt-hold-pattern-on-weekly-charts-tread-with-caution-3544931.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty around 10,700, Sensex falls 100 points; pharma stocks under pressure

Market Opens: Benchmark indices started on flat note on Friday with Nifty trading below 10,750 mark.

The Sensex is down 32.22 points at 35844.00, while Nifty is down 18.30 points at 10727.70. About 332 shares have advanced, 515 shares declined, and 41 shares are unchanged.

Power Grid, BPCL, L&T, IOC, Axis Bank, ONGC, are among major gainers, while losers are Eveready, JK Tyre, Yes Bank, Nestle, Jet Airways, JSW Steel, UltraTech Cement, Hero Moto, Sun Pharma, HDFC and Vedanta.

Among sectoral indices, except energy and infra all other indices are trading in red.

Rupee Opens: The Indian rupee opened marginally lower at 71.23 per dollar on Friday versus Thursday's close 71.16.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-around-10700-sensex-falls-100-points-pharma-stocks-under-pressure-3540771.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 14, 2019

Nifty around 10,750, Sensex falls 100 pts; Yes Bank surges 29%

Market Opens: Benchmark indices are trading lower on the Thursday morning with Nifty hovering around 10,750 level.

At 09:18 hrs IST, the Sensex is down 52.52 points at 35981.59, while Nifty is down 26.20 points at 10767.50. About 304 shares have advanced, 495 shares declined, and 30 shares are unchanged.

Karur Vysya Bank, IOC, BPCL, HPCL, Reliance Capital, Repco Home Finance, DHFL, RIL, Kotak Mahindra Bank are among major losers, while Yes Bank is up 27 percent, while Tata Motors, L&T are other major gainers.

Rupee Opens: The Indian rupee opened lower at 70.87 per dollar on Thursday versus previous close 70.80.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-around-10750-sensex-falls-100-pts-yes-bank-surges-29-3533371.html

If you need more information about the Stock Market:Visit: http://www.tradeindiaresearch.com

Tuesday, February 12, 2019

Flat start on D-Street, Nifty below 10,900; Axis Bank down 1%

Market opens Equity benchmarks have begun marginally lower, with the Nifty trading just below 10,900.

The Sensex is down 47.42 points or 0.13% at 36347.61, and the Nifty down 13.70 points or 0.13% at 10875.10. The market breadth was narrow as 179 shares advanced, against a decline of 137 shares, while 43 shares were unchanged.

Majority of sectoral indices are trading in the near the flat line, but pain is visible among automobiles, IT and metals. The Midcap index is trading flat.

Coal India, Tata Motors, Indiabulls Housing and IOC were the top gainers, while NTPC, Axis Bank, GAIL and Eicher Motors lost the most.

The Indian rupee has witnessed a flat opening at 71.17 per US dollar against Monday’s close of 71.18 per US dollar.

The rupee strengthened by 13 paise to close at 71.18 against the US dollar Monday on easing crude oil prices, even as the greenback strengthened vis-a-vis other major currencies.

Source:https://www.moneycontrol.com/news/business/markets/market-live-flat-start-on-d-street-nifty-below-10900-axis-bank-down-1-3517941.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 11, 2019

Closing bell: Nifty closes below 10,900, Sensex loses 151 pts; midcaps underperform

Market Closing

Benchmark indices continued to reel under selling pressure for third consecutive session on Monday. The 30-share BSE Sensex fell 151.45 points to 36,395.03 and the Nifty50 plunged 54.80 points to 10,888.80.

The broader markets also caught in bear trap with the Nifty Midcap index falling 1.7 percent and Smallcap shedding 1.8 percent, underperforming frontliners.

The market breadth was largely in favour of bears as about two shares declined for every share rising on the NSE.

Reliance Industries and ICICI Bank were leading contributors to the Nifty's fall.

Dr Reddy's Labs and M&M were biggest losers among Nifty50 stocks, down more than 5 percent each. ONGC, Hindalco Industries and UltraTech Cement were down 4-5 percent.

However, Tata Steel, Cipla, IOC, Tata Motors and HCL Technologies gained 1-2.5 percent.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-closes-below-10900-sensex-loses-151-pts-midcaps-underperform-3509041.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Friday, February 8, 2019

Closing Bell: Sensex plunges over 420 points, Nifty gives up 10,950; Tata Motors down 18%

Market at Close Equity benchmarks witnessed intensified selloff in the last hour, which dragged the market to lower points. The Nifty gave up 11,000-mark, while the Sensex dropped over a percent.

Across sectors, selling was visible, with maximum pain seen in automobiles, consumption, metals, and infra companies, among others.

At the close of market hours, the Sensex was down 424.61 points or 1.15% at 36546.48, while the Nifty was down 125.80 points or 1.14% at 10943.60. The market breadth was negative as 950 shares advanced, against a decline of 1,552 shares, while 125 shares were unchanged.

Kotak Mahindra Bank, Bharti Airtel, and Bharti Infratel were the top gainers, while Tata Motors, Vedanta, and Indiabulls Housing lost the most.

Source: https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-plunges-over-420-points-nifty-gives-up-10950-tata-motors-down-18-3501321.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Brokerages press the panic button for Tata Motors; stock hits 10-year low

Brokerage firms such as Axis Capital and Motilal Oswal downgraded Tata Motors post December quarter results which were impacted by an exceptional item of asset impairment of Rs 27,838 crore.

The company had reported a profit of Rs 1,214.6 crore in the same quarter last fiscal. The company's consolidated revenue in Q3 was at Rs 77,001 crore while operating profit was at Rs 6,522 crore.

The stock fell more than 20% to Rs 141.90 in the morning trade on February 8 after opening at Rs 164.65 on BSE. The stock closed at Rs 182.90 on February 7 on BSE.

Reacting to the results, most brokerage firms reduced their earnings per share (EPS) estimate for Tata Motors and reduced their target price on the stock. CLSA, which retained sell rating on Tata Motors, has a target price of Rs 150 which translates into a downside of 17 percent from Thursday’s close.

JLR reported a loss for the third straight quarter as net sales declined by 1 percent on a YoY basis to GBP 6.2 billion, as volumes fell 11 percent on a YoY basis. EBITDA margin shrank 180 bps to 7.3 percent impacted by one-off cost on account of de-stocking and warranty cost.

JLR margins declined on a QoQ basis despite higher volume. The big asset impairment dragged Tata into a consolidated loss. The demand outlook has worsened in recent quarters in China & India.

The global investment bank slashed its FY19-21 EPS estimate by 2-66 percent. The stock will remain weak given insufficient near-term product triggers, said the CLSA note.

The weak sales in China and de-stocking has impacted JLR numbers. The December quarter JLR revenue was at 6.2 billion pounds, while the loss stood at 3,129 million pounds.

Source:https://www.moneycontrol.com/news/business/markets/brokerages-press-the-panic-button-for-tata-motors-stock-tanks-20-3501381.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Subscribe to:

Posts (Atom)

Closing Bell: Sensex ends 192 pts lower, Nifty below 11,600 even as RBI cuts rate

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

CLOSING BELL:- SENSEX UP +242.82 @ 35726.29 NIFTY FUTURE UP +61.20 @ 10847.00 BANKNIFTY FUTURE UP +159.00 @ 26636.00 I...

-

If you want more information regardingtheMarket News & many other tips like Intraday Tips , MCX Normal Calls , Indore Advisory Compan...

-

Gold gained on Thursday, supported by an easing dollar as investors awaited progress on the ongoing Sino-U.S. trade negotiations after...