Get daily stock tips and news with complete details on this platform. We have experienced research team which analyze share market and provide useful recommendations. For More, Visit Now!

Showing posts with label Company In Indore. Show all posts

Showing posts with label Company In Indore. Show all posts

Friday, February 15, 2019

Wednesday, February 13, 2019

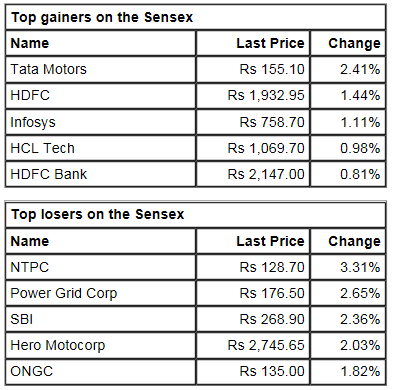

Closing Bell: Sensex ends 119 pts lower, Nifty below 10,800; Eicher Motors slides 5%

Market at close: Benchmark indices erased all its intraday gains and ended in red on the back of last hour selling pressure.

The Sensex was down 119.51 points at 36034.11, while Nifty was down 37.70 points at 10793.70. About 968 shares have advanced, 1544 shares declined, and 128 shares are unchanged.

Adani Ports, Indiabulls Housing, UPL, Tata Motors and HDFC were the top gainers on the Nifty, while losers included Eicher Motors, IOC, HPCL, GAIL and ONGC.

Except IT index, all other sectoral indices closed in red led by Nifty PSU bank, infra, energy, auto, pharma and metal.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-ends-119-pts-lower-nifty-below-10800-eicher-motors-slides-5-3525251.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Inflation drops to 2.05%, lower than RBI's projection a week ago

There is something to be said about inflation. It's a number that is stubbornly refusing to rise. January inflation came in at just 2.05 percent, a near-two year low. And it's happening like this: the inflation index is actually falling – and falling even more than it fell last year.

Which brings us to the components. While food is still an important part of the index, it's still "deflating" – prices of food items are falling, in general. This is usual for January (as winter crops come abound) but we see that this time, there was more "abundance" than last year.

If you need more information about the Stock Market:

Which brings us to the components. While food is still an important part of the index, it's still "deflating" – prices of food items are falling, in general. This is usual for January (as winter crops come abound) but we see that this time, there was more "abundance" than last year.

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Source:https://www.moneycontrol.com/news/business/economy/inflation-drops-to-2-05-lower-than-rbis-projection-a-week-ago-3529521.html

Tuesday, February 12, 2019

Hindalco Q3 profit including Utkal surges 47% to Rs 713 cr, margin contracts

third quarter profit (including Utkal) to Rs 713 crore, driven by higher operating income and lower finance cost in aluminium business.

Profit during the quarter ended December 2017 stood at Rs 484 crore.

Revenue from operations (including Utkal) grew by 8 percent year-on-year to Rs 11,938 crore in quarter ended December 2018.

At operating level, EBITDA (earnings before interest, tax, depreciation and amortisation) including Utkal rose 3.5 percent to Rs 1,926 crore in Q3 YoY, but margin contracted to 16.1 percent against 16.9 percent in same period last year.

"This is on the back of supporting macros, improvement in operational efficiencies and better realisations. This was despite increase in input costs, mainly of coal and furnace oil," the aluminium major said.

Interest expenses for the quarter were lower by 12 percent to Rs 477 crore YoY, mainly due to re-pricing of long term project loans and loan re-payments.

The company said under its continuous deleveraging focus, it prepaid another Rs 1,575 crore in October 2018.

Hence, Hindalco standalone plus Utkal Alumina net debt to EBITDA (on TTM Basis) improved to 2.36x as on December 2018 from 2.67x as on March 2018, it added.

Aluminium business (including Utkal) during the quarter grew by 12.6 percent to Rs 6,018 crore with its EBITDA increasing 8 percent to Rs 1,286 crore YoY on supporting macros, partially offset by increase in the input prices.

The company achieved aluminium metal production of 324 Kt in Q3FY19, as its plants continued to operate at peak designed capacities, the company said, adding alumina (including Utkal Alumina) production was higher at 749 Kt versus 734 Kt in the corresponding period last year on account of better operational performance.

Copper business revenue at Rs 5,925 crore increased by 4 percent and its operating income at Rs 431 crore was higher by 2.4 percent for quarter ended December 2018.

At 14:38 hours IST, the stock was quoting at Rs 199.65, up Rs 0.30, or 0.15 percent on the BSE.Source:https://www.moneycontrol.com/news/business/earnings/hindalco-q3-profit-including-utkal-surges-47-to-rs-713-cr-margin-contracts-3521481.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

JBM Auto rises nearly 2% after strong Q3 results

Shares of JBM Auto rose about 2 percent in early trade on February 12 after the company reported strong results for the quarter ended December 2018.

Consolidated net profit after tax rose to Rs 19.74 crore, up 14.6 percent from the same quarter last year.

JBM Auto's revenue from operations in Q3 was Rs 429.89 crore, an increase of 8.46 percent from the same quarter last year.

Earnings per share (EPS) for the third quarter rose to Rs 4.22 from Rs 3.71 in the corresponding quarter last year.

Source:https://www.moneycontrol.com/news/business/markets/jbm-auto-rises-nearly-2-after-strong-q3-results-3517961.html

At 0926 hours, JBM Auto was quoting at Rs 260.85, up Rs 3.80, or 1.48 percent.If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Flat start on D-Street, Nifty below 10,900; Axis Bank down 1%

Market opens Equity benchmarks have begun marginally lower, with the Nifty trading just below 10,900.

The Sensex is down 47.42 points or 0.13% at 36347.61, and the Nifty down 13.70 points or 0.13% at 10875.10. The market breadth was narrow as 179 shares advanced, against a decline of 137 shares, while 43 shares were unchanged.

Majority of sectoral indices are trading in the near the flat line, but pain is visible among automobiles, IT and metals. The Midcap index is trading flat.

Coal India, Tata Motors, Indiabulls Housing and IOC were the top gainers, while NTPC, Axis Bank, GAIL and Eicher Motors lost the most.

The Indian rupee has witnessed a flat opening at 71.17 per US dollar against Monday’s close of 71.18 per US dollar.

The rupee strengthened by 13 paise to close at 71.18 against the US dollar Monday on easing crude oil prices, even as the greenback strengthened vis-a-vis other major currencies.

Source:https://www.moneycontrol.com/news/business/markets/market-live-flat-start-on-d-street-nifty-below-10900-axis-bank-down-1-3517941.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 11, 2019

Closing bell: Nifty closes below 10,900, Sensex loses 151 pts; midcaps underperform

Market Closing

Benchmark indices continued to reel under selling pressure for third consecutive session on Monday. The 30-share BSE Sensex fell 151.45 points to 36,395.03 and the Nifty50 plunged 54.80 points to 10,888.80.

The broader markets also caught in bear trap with the Nifty Midcap index falling 1.7 percent and Smallcap shedding 1.8 percent, underperforming frontliners.

The market breadth was largely in favour of bears as about two shares declined for every share rising on the NSE.

Reliance Industries and ICICI Bank were leading contributors to the Nifty's fall.

Dr Reddy's Labs and M&M were biggest losers among Nifty50 stocks, down more than 5 percent each. ONGC, Hindalco Industries and UltraTech Cement were down 4-5 percent.

However, Tata Steel, Cipla, IOC, Tata Motors and HCL Technologies gained 1-2.5 percent.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-nifty-closes-below-10900-sensex-loses-151-pts-midcaps-underperform-3509041.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Friday, February 8, 2019

Closing Bell: Sensex plunges over 420 points, Nifty gives up 10,950; Tata Motors down 18%

Market at Close Equity benchmarks witnessed intensified selloff in the last hour, which dragged the market to lower points. The Nifty gave up 11,000-mark, while the Sensex dropped over a percent.

Across sectors, selling was visible, with maximum pain seen in automobiles, consumption, metals, and infra companies, among others.

At the close of market hours, the Sensex was down 424.61 points or 1.15% at 36546.48, while the Nifty was down 125.80 points or 1.14% at 10943.60. The market breadth was negative as 950 shares advanced, against a decline of 1,552 shares, while 125 shares were unchanged.

Kotak Mahindra Bank, Bharti Airtel, and Bharti Infratel were the top gainers, while Tata Motors, Vedanta, and Indiabulls Housing lost the most.

Source: https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-plunges-over-420-points-nifty-gives-up-10950-tata-motors-down-18-3501321.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Thursday, February 7, 2019

Closing Bell: Sensex, Nifty end flat on policy day; Sun Pharma, Zee Ent gain 4% each

Market at close: Benchmark indices ended flat on Thursday with Nifty ended above 11,000 level.

RBI in its MPC meeting has cut repo rate by 25 bps at 6.25 percent.

The Sensex was down 4.14 points at 36971.09, while Nifty was up 6.90 points at 11069.40. About 1377 shares have advanced, 1145 shares declined, and 164 shares are unchanged.

Zee Entertainment, Sun Pharma, Eicher Motors, Bharti Infratel and Bajaj Auto are the top gainers on the Nifty, while losers include JSW Steel, Reliance Industries, L&T, Hindalco and Power Grid.

Among the sectors, auto, FMCG, IT and pharma index saw some buying interest, while energy and infra index remain under pressure.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-nifty-end-flat-on-policy-day-sun-pharma-zee-ent-gain-4-each-3494811.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Wednesday, February 6, 2019

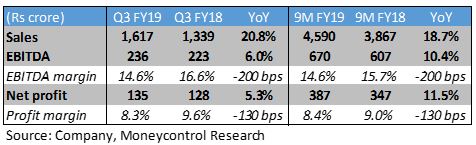

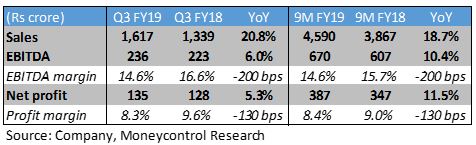

Berger Paints Q3FY19 review: Volume drives topline, but crude prices hurt margins

Highlights:

- Q3 volume growth was strong at nearly 14-15 percent

- Festive demand aided topline growth

- Management expects margins to recover in Q4

- Competitive intensity to increase going forward

- Valuations offer little upside from current levels

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

- Q3 volume growth was strong at nearly 14-15 percent

- Festive demand aided topline growth

- Management expects margins to recover in Q4

- Competitive intensity to increase going forward

- Valuations offer little upside from current levels

India’s second-largest decorative paints company reported better-than-expected Q3FY19 topline. Volume growth was in high teens, at par with its larger peer Asian Paints. Operating margins, however, contracted as high crude oil prices expanded the cost base. The company appears to be on a secular growth path as it continues to grow faster than the industry, gaining market share from smaller and unorganised players.

Key Q3 positives

- Topline growth of 21 percent was driven by strong volume growth. The decorative volume growth estimates for the quarter stood at nearly 14 percent as strong consumer demand during the festive season along with a favourable base (timing of Diwali) aided the sales growth in October-December period.

- Operating profit margins recovered sequentially with successive price hikes partially alleviating the crude-oil and currency-related pressures. However, high-cost inventory kept margins under pressure on YoY basis.

- Apart from strong demand in the decorative business, there was decent traction in industrials, Nepal decorative business, and Saboo Coatings.

- The management expects a recovery in Q4 margins from softening crude prices and rupee stabilisation against the dollar.

Source: https://www.moneycontrol.com/news/business/moneycontrol-research/berger-paints-q3fy19-review-volume-drives-topline-but-crude-prices-hurt-margins-3491201.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, February 4, 2019

Saturday, February 2, 2019

Budget 2019 effect: How you can earn tax-free Rs 10 lakh per annum

In a move to give relief to the middle class, Finance Minister Piyush Goyal announced in the Budget 2019 that individual taxpayers will get a full tax rebate for income earned up to Rs 5 lakh.

Previously, the income threshold on which rebate was given was Rs 3.5 lakh. Individuals will now get a benefit of Rs 12,500, up from Rs 2,500 earlier. This will benefit taxpayers only to the extent of an annual income of Rs 5 lakh. The basic exemption limit and tax-slabs remain the same.

Additionally, Piyush Goyal also announced an increase in standard deduction to Rs 50,000, up from Rs 40,000 earlier.All the tax slabs also continue. In other words, if your taxable income is higher than Rs 5 lakh, you still pay tax at the existing income tax slabs.

To be sure, this is a rebate for those whose taxable incomes are up to Rs 5 lakh. The basic exemption limit of Rs 2.5 lakh - that is, no tax to be paid for those who earn an income of up to Rs 2.5 lakh - continues.

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com \

Thursday, January 31, 2019

Nifty below 10,700, Sensex up 150 points; Zee Ent, Bajaj Finance slip

Market Opens: Benchmark indices opened higher on Thursday with Nifty trading around 10,700.

At 09:17 hrs IST, the Sensex is up 205.23 points at 35796.48, while Nifty is up 44.40 points at 10696.20. About 532 shares have advanced, 242 shares declined, and 26 shares are unchanged.

Tata Steel, RIL, Grasim, Vedanta, ICICI Bank, UltraTech Cement, Coal India, UPL, Eicher Motors are trading higher, while BPCL, IOC, HPCL, Bharti Infratel, Adani Port, HDFC, Zee Entertainment are among losers.

All the sectoral indices are trading in green, midcap index is up 0.50 percent.

Rupee Opens: The Indian rupee gained in the early trade on Thursday. It has opened higher by 17 paise at 70.95 per dollar versus previous close 71.12.

Source: https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-below-10700-sensex-up-150-points-zee-ent-bajaj-finance-slip-3459401.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Monday, January 28, 2019

Friday, January 25, 2019

Wednesday, January 23, 2019

Nifty forms bearish candle after consolidation, 10,790 crucial for bulls

The Nifty50 after rangebound trade fell sharply in last hour of trade on Wednesday and formed big bearish candle on the daily charts, weighed by index heavyweights HDFC Bank, Infosys, HDFC and Reliance Industries.

ITC was the biggest loser, down over 4 percent after margin disappointment in Q3.

The immediate crucial support for the index could be 10,790, experts said, adding if it breaks that level then there could be sharp fall in coming sessions.

Overall index has got stuck in a broader trading range of 10,700 to 10,985 zones and requires a decisive range breakout for next leg of rally, experts said.

The Nifty50 after opening flat remained rangebound, but started falling in last hour of trade and hit an intraday low of 10,811.95. The index closed 91.30 points lower at 10,831.50 after breaking its consolidation range of last five trading sessions.

"Recent breakout appears to have whipsawed as Nifty50 signed off the session with a strong bearish candle from around critical resistance point of 10,950 levels. However, still larger picture remains that of sideways as Nifty50 is unable to attract any follow through action in recent past," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

He said interestingly last 13 days of price action carved out a small ascending channel whose support is placed around 10,790 levels.

In case if Nifty slide continues below 10,790 levels then based on this channel breakdown another 200 points fall can be expected with a initial target of 10,571 levels, according to him.

Mazhar said in between Nifty may find some meaning full support around 10,690 levels where as upsides shall remain capped around 10,950. Hence, aggressive traders can go short on Nifty if it trades below 10,790 for one hour and look for a target of 10,600, he advised.

India VIX moved up by 0.58 percent to 18.08 levels. Volatility has to cool down below 16 zones to get a decisive range breakout.

On the option front, maximum Put open interest (OI) is at 10,500 followed by 10,800 strike while maximum Call OI is at 11,000 followed by 10,900 strike.

Meaningful Call writing is at 11,000 followed by 10,900 strike while Put unwinding is at most of the immediate strikes. Option band signifies a trading range in between 10,700 to 11,000 zones.

"Nifty index started to form lower highs - lower lows on daily scale from last two sessions as it failed to surpass multiple hurdle of last nine weeks at 10,985 zones," Chandan Taparia, Associate Vice President | Analyst-Derivatives at Motilal Oswal Financial Services told Moneycontrol.

He said now if it sustains below 10,880 zone then it may drift towards it 50 DEMA and next major support at 10,777 then 10,700 zones while on the upside hurdles are seen at 10,929 then 10,985 levels.

Bank Nifty finally broken its consolidation band of last five trading sessions from 27,350 to 27,600 zones and slipped towards 27,190 levels. It closed 231.50 points lower at 27,250.75 and formed a bearish candle on daily scale as supply pressure is visible at higher levels.

"It has taken multiple hurdle at 27,600 zones and resistances are shifting lower. Now it has to cross and hold above 27,350 zones to witness an upmove towards 27,600 then 27,750 zones while immediate support exists at 27,150 then 27,000 zones," Taparia said.

Source:https://www.moneycontrol.com/news/business/markets/technical-view-nifty-forms-bearish-candle-after-consolidation-10790-crucial-for-bulls-3426401.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Subscribe to:

Posts (Atom)

Closing Bell: Sensex ends 192 pts lower, Nifty below 11,600 even as RBI cuts rate

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

CLOSING BELL:- SENSEX UP +242.82 @ 35726.29 NIFTY FUTURE UP +61.20 @ 10847.00 BANKNIFTY FUTURE UP +159.00 @ 26636.00 I...

-

If you want more information regardingtheMarket News & many other tips like Intraday Tips , MCX Normal Calls , Indore Advisory Compan...

-

Gold gained on Thursday, supported by an easing dollar as investors awaited progress on the ongoing Sino-U.S. trade negotiations after...