Get daily stock tips and news with complete details on this platform. We have experienced research team which analyze share market and provide useful recommendations. For More, Visit Now!

Wednesday, February 20, 2019

Tuesday, February 19, 2019

Closing Bell: Sensex ends 145 pts lower, Nifty manages to hold 10,600; IT stocks drag

Market at close: Bears dragged the Nifty below 10,600 during last hour trading but managed to close just above the 10,600 level.

At the end, Sensex was down 145.83 points at 35352.61, while Nifty was down 36.60 points at 10604.40. About 1360 shares have advanced, 1169 shares declined, and 122 shares are unchanged.

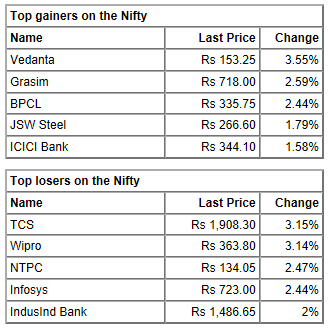

Wipro, TCS, IndusInd Bank, NTPC and Infosys were the top losers on the Nifty while top gainers include Vedanta, Grasim Industries, BPCL, Zee Entertainment, and JSW Steel.

IT space was a major drag among the sectors followed by pharma and energy, while buying was seen in FMCG, metal and PSU bank index.

Source:https://www.moneycontrol.com/news/business/markets/closing-bell-sensex-ends-145-pts-lower-nifty-manages-to-hold-10600-it-stocks-drag-3555261.html

If you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty above 10,650, Sensex up 100 points; Emami rises 5% after stake sale

Market Opens: It is a flat start for the Indian Indices with Nifty hovering around 10650 level.

The Sensex is up 51.90 points at 35550.34, while Nifty is up 15.40 points at 10656.40. About 497 shares have advanced, 249 shares declined, and 37 shares are unchanged.

Gainers include Jet Airways, Ambuja Cements, Dr Reddy's Lab, Sun Pharma, Grasim, JSW Steel, Hindalco, Emami, while losers are Indiabulls Housing, Wipro, HDFC, Adani Port and IDFC.

Source:https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-bse-nse-nifty-above-10650-sensex-up-100-points-emami-rises-5-after-stake-sale-3555261.html

If you need more information about the Stock Market:Visit: http://www.tradeindiaresearch.com

Monday, February 18, 2019

Closing Bell: Market falls for 7th consecutive day; 5 factors that dragged Sensex over 300 pts

The market fell sharply on first day of the week starting February 18 and continued its downtrend for seventh consecutive session on Monday with the Nifty falling below 10,700-levels, dragged by Reliance Industries, TCS, ITC and HDFC Bank.

Reducing foreign inflows due to fear of escalation of tensions at the border also impacted the sentiment.

The benchmark indices opened flat, but immediately started consolidating. The recent profit-taking phase in private banks and IT majors, which were holding the benchmark indices, are adding to the negatives.

At close, the 30-share BSE Sensex was down 310.51 points at 35,498.44 and the Nifty50 fell 83.40 points to 10,641.

"Contrary to past statistical evidence, Nifty is showing signs of decoupling with the US market. Almost all Asian markets were up today and US too was up on Friday but still Nifty slipped deep in the red. Such decoupling is good in the long-term interest of the Indian markets. The bears have tightened their grip in the market," Umesh Mehta, Head of Research at Samco Securities told Moneycontrol.

Jayant Manglik, President at Religare Broking feels traders have no option but to follow the prevailing bias and prefer hedged positions instead of naked trades.

Source:https://www.moneycontrol.com/news/business/markets/market-falls-for-7th-consecutive-day-5-factors-that-dragged-sensex-over-300-pts-3553541.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Nifty could bounce back with immediate trading range of 10,700-11,000

Last week, market breadth was largely in favour of bears and selling pressure was witnessed in every sector. Market is trading below its three major simple moving averages 20 DMA, 50 DMA and 200 DMA which are placed between 10,820 and 10,850 levels, suggesting strong resistance zone on the higher side.

Middle regression line of linear regression channel is placed around 10,850 levels, while a normal bounce back towards this strong confluence zone is awaited.

Majority of the momentum oscillators are in oversold zone creating the possibility of a bounce back.

Nifty has taken support from the lower support trend line of broadening wedge pattern which is in making since last two months, and mid-point of it is around 10,840 and any decisive move below the crucial support of 10,640 will push it at lower towards 10,500-10,350 levels.

At the same time volatility index, VIX has closed below 16 marks. Moreover, a decisive move above the stiff resistance of 10,860 will push it higher towards previous swing high 10,985.

Looking at the derivative structure, highest Open Interest (OI) in Put is seen around 10,700 strikes whereas maximum Open Interest (OI) in Call is around 11,000 levels, followed by 11,200. Option data indicates an immediate trading range between 10,700 and 11,000 marks.

Source:https://www.moneycontrol.com/news/business/markets/nifty-could-bounce-back-with-immediate-trading-range-of-10700-11000-3547971.html

If you need more information about the Stock Market:Visit: http://www.tradeindiaresearch.com

Subscribe to:

Posts (Atom)

Closing Bell: Sensex ends 192 pts lower, Nifty below 11,600 even as RBI cuts rate

Market at close: Benchmark indices ended lower but off day's low after Reserve Bank of India (RBI) slashed repo rate by 25 bps to 6...

-

CLOSING BELL:- SENSEX UP +242.82 @ 35726.29 NIFTY FUTURE UP +61.20 @ 10847.00 BANKNIFTY FUTURE UP +159.00 @ 26636.00 I...

-

The year 2018 was not a golden year for investors in terms of percentage returns. The S&P BSE Sensex rose by about 6 percent while...

-

Himatsingka Seide (HSL), one of India’s largest home textile majors and exporters, draws our attention on account of improving busine...