After a subdued start on Monday ahead of election result of five states, the market bounced back from the low point in the week ended December 14 amid strong domestic economic data and mixed global cues.

Despite BJP losing all three states, strong IIP and better WPI and CPI lent some support to the market.

India's WPI inflation, which is calculated on wholesale prices, fell to 4.64 percent in November 2018, from 5.28 percent in October on lower power and fuel inflation and food deflation. However, November WPI core inflation was at 4.8 percent against 5.1 percent, MoM.

On the other hand, India’s industrial production (IIP) grew 8.1 percent in October as against 4.5 percent in September, while CPI inflation eased to 2.33 percent in November compared to 3.4 percent in October.

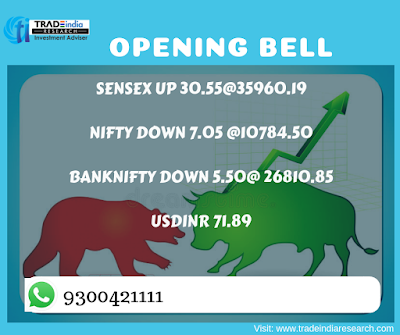

The Sensex rose 0.81 percent this week, or 289.68 points, to ending at 35962.93, while Nifty was up 1.04 percent, or 111.75 points, to close at 10805.45.

On a weekly basis, the rupee depreciated 1.53 percent (Rs 1.09) against the dollar as it ended at 71.89 on December 14 against December 07, closing of 70.80 against the dollar.

Source:https://www.moneycontrol.com/news/business/markets/week-in-5-charts-sensex-nifty-up-1-on-strong-iip-easing-wpi-data-3293991.htmlIf you need more information about the Stock Market:

Visit: http://www.tradeindiaresearch.com

Call On TOLL FREE Number: 9009010900

Whatsapp User Join Our Group: 9300421111